Economics Seminar(2017-1)

Topic: Unintended Effects of Estate Taxation on Wealth Inequality

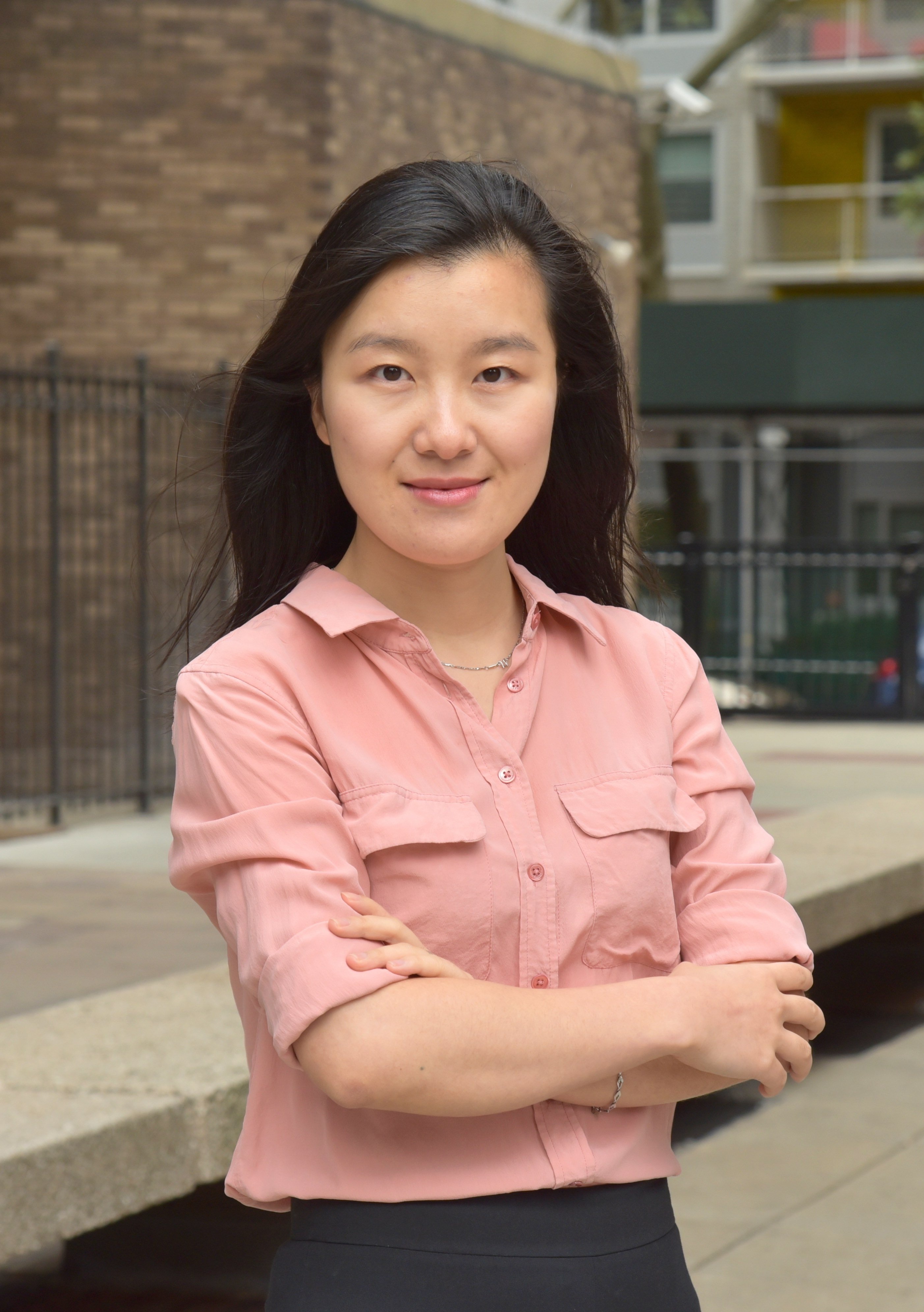

Speaker: Mi Luo, New York University

Time: Friday, February 17, 14:00-15:30

Place: Room 217, Guanghua Building 2

Abstract:

Intergenerational wealth transmission occurs not only at the end of life (bequests)

but also throughout the life cycle (inter-vivos transfers). This paper documents that bequests

are largely accidental, and inter-vivos transfers are intentional and negatively correlated with

the recipient’s current income. This paper builds and estimates a general-equilibrium lifecycle

model of intergenerational wealth transfers, where parents potentially value inter-vivos

transfers differently from bequests. The model renders a response in inter-vivos transfers to

estate tax changes close to the data. Under the current U.S. tax codes, increasing the estate

tax does not necessarily reduce top wealth inequality. Instead, it could potentially increase

inequality with a sufficiently strong response in inter-vivos transfers. Such a response is

partly caused by differential tax treatment between inter-vivos transfers and bequests, and

partly amplified by the wealthier people responding more due to the preference curvature

for both transfers.

Introduction:

Mi Luo is a Ph.D. candidate in the Department of Economics, New York University. She was a C.S.W.E.P. Dissertation Intern at the New York Fed. She also worked at the Consumer Payments Research Center of Boston Fed as a part-time Senior Research Assistant for two years. Her research interests are macroeconomics, household finance, and labor economics.

Your participation is warmly welcomed!